car lease tax deduction hmrc

BIM47714 - Specific deductions. Eligible expenses include your lease payment gas oil tires tune-ups registration fees and insurance.

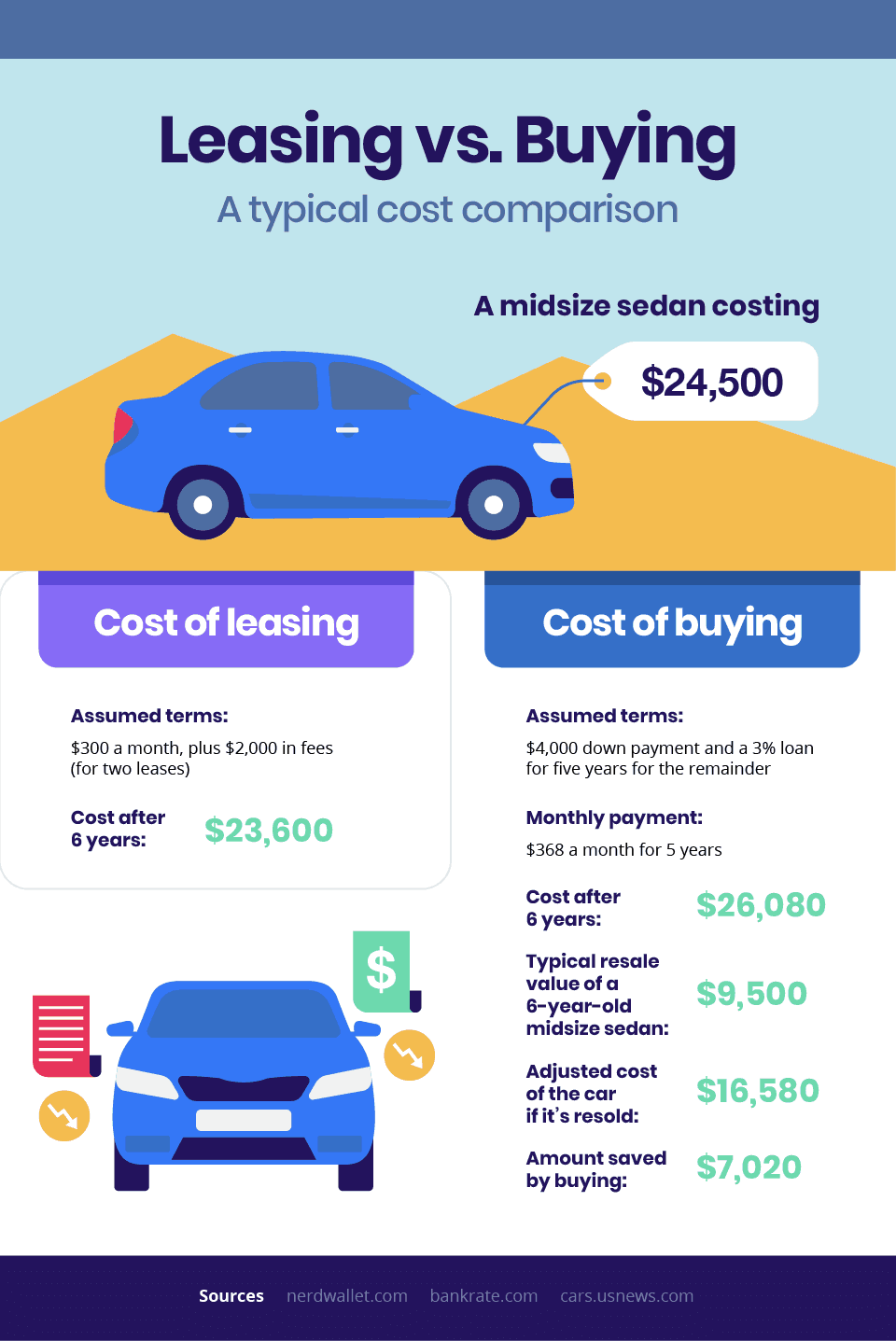

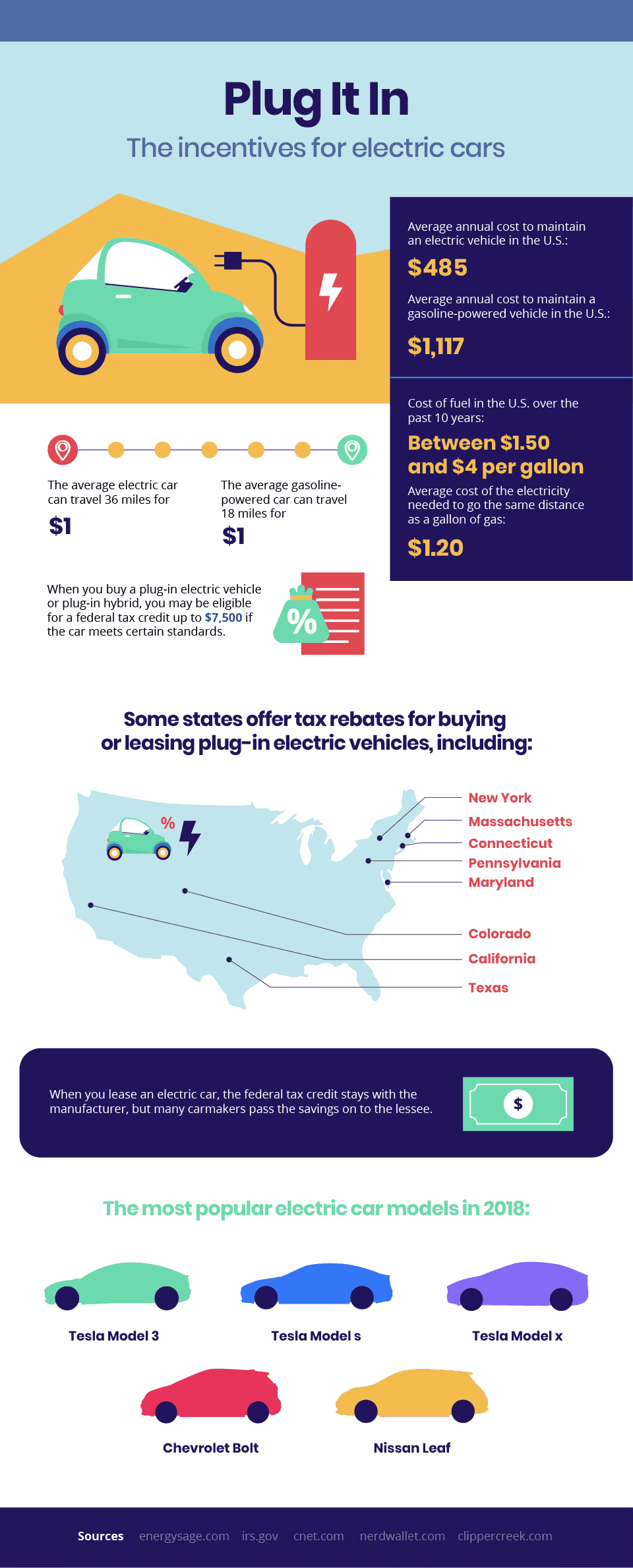

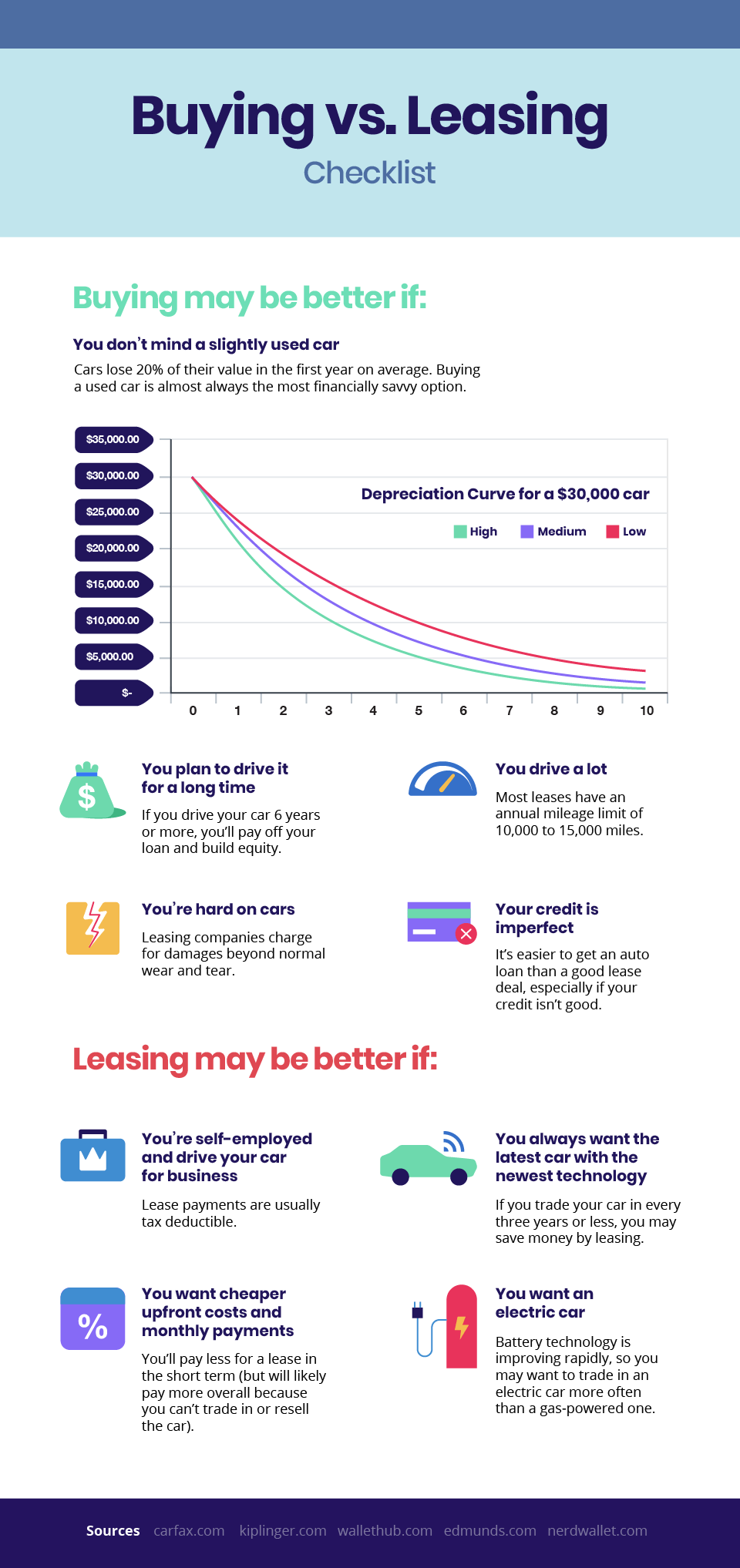

Is It Better To Buy Or Lease A Car Taxact Blog

However the car will count as a benefit-in-kind on your personal tax return.

. That means that you can claim your monthly lease payments as a business expense. The HMRC document discusses possible ways to preserve incentivisation. For corporation tax purposes the thresholds noted above apply for cars leased on or after 1 April 2021.

This could be the deciding factor between taking out a limited company lease or a fully personal lease. The alternative of special rates of depreciation for tax the lease allowance -. A company car is not free.

The so-called SALT deduction has been around for a while and it allows eligible taxpayers to deduct certain state and local taxes such as property tax and income tax or sales tax. But what about if youre leasing a car. As the name suggests youre deducting the actual costs of your leased car.

The idea of purchasing or leasing a business vehicle should definitely be considered. Hire periods beginning on or after 16 April 2009. Claiming a Car Lease Tax Deduction.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Company car leasing payments are not fully tax-deductible if. With TurboTax Its Fast And Easy To Get Your Taxes Done Right.

In certain cases the deduction for the cost of hiring a. This means the question of whether car lease payments are tax-deductible is important. Car lease tax deduction hmrc.

To deduct your car lease payments from your LLCs tax return. When you lease a car via your employer HMRC will be made aware of this and will charge you the appropriate level of tax for enjoying this benefit. If you are in essence renting it and will hand it back in the future then it is classed as an operating lease.

This is where drivers do need to be careful as this will affect their taxpension moving forwards. You can write off the cost of your business lease as a business expense on your tax return. Whether you are a self-employed businessman or a larger corporation your yearly tax bill with HMRC can be greatly reduced by offsetting your company cars.

Beginning January 1 2021 certain used vehicle dealers are required to pay the applicable sales tax on their retail sales of vehicles directly to the Department of Motor Vehicles. On June 29 2020 California passed Assembly Bill AB 85 Stats. This means you only pay tax on the part of the car you lease not the entire value of the car.

Use the Vehicle Certification Agencys online tool to find out your cars CO2 emissions. Since the lease payment includes sales tax depreciation and other costs the tax-deductible amount under a. The Basics If you lease a new car for use in your business you will probably be able to deduct the lease payments from your taxes as a business deduction.

If capital allowances are claimed on the right of use asset this may presuppose capital allowances are preserved in the wider tax system. For more information about tax on company cars visit the HM Revenue Customs HMRC website. The auto lease inclusion is netted against the amount of the lease payment deductions No.

The maximum expense deductions for rented cars that qualify for tax deductions is 9600 annually a total of 800 in monthly lease payments plus HST as compared to 6332 for leased trucks. Get Your Max Refund Today. Mileage Business expenses can rack up fast so its crucial that you keep a record of all your motoring expenses that you have collected so you have proof to provide to the HMRC when you claim them back at the end of the year.

Lets see how the HMRC treats car leasing when it comes to tax reliefIf your company is leasing a vehicle you dont own it. Cars - restriction of hiring costs. The most common method is to tax monthly lease payments at the local sales tax rate.

To be eligible for the tax deductions you should fall into one of the following categories. When filling in your form you must account for any personal miles which may have been put on the car by employees as you will either only be able to reclaim VAT for business mileage or reclaim VAT for all. However you need to be careful and keep track of all the miles you spend in the car and whether the miles traveled are for business or personal reasons.

For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment figure. You know by now that you can get tax deductions for the personal use of a business car. You may be able to calculate your car van or motorcycle expenses using a flat rate known as.

How Much Car Lease Can You Write Off. With a van lease 100 of tax is deductible and you are able to claim it all back as long as you meet. If you pay sales tax on your car lease you may be able to take a deduction for it on your federal income taxes.

BIM47725 - Specific deductions. The good news is that for most types of lease including contract hire car lease payments are tax-deductible for corporation tax purposes. 50 gkm or below.

And lengthens the time in which the benefits of a tax deduction are realized depending on the purchase price of the vehicle. Because when you lease a company car or van you dont own it you technically rent it and thats an ongoing expense. Cars - restriction of hiring costs.

With a car lease you can claim your monthly payments as a business expense meaning you can reclaim a percentage of VAT depending on the ratio of personalbusiness use. Tot up your car lease payments plus any other expenses such as insurance and petrol which you paid through the company. However there are a number of provisos that should be considered.

Nevertheless for cars with CO2 emissions. 8 and AB 82 Stats. In order to make tax deductions on a leased car you need to submit a final VAT return form to HMRC which can be done either online or via compatible accounting software.

25 all cars including zero emission cars with a list price above 40000 also attract a supplement of 310 in addition to the sr for the first 5 years in which the sr is paid. Leasing a commercial vehicle through a limited company One of the tax advantages to leasing a van can include claiming up to 100 per cent VAT back on the monthly payments if youre a VAT-registered business and it is only for business use. This means that if the car has emissions under 110gkm you can get tax relief on all of the payments.

For income tax purposes the thresholds apply for cars leased on or after 6 April 2021.

Tax Implications Of Business Car Leasing Company Car Lease Tax

Are Car Lease Payments Tax Deductible Lease Fetcher

Is It Better To Buy Or Lease A Car Taxact Blog

How To Deduct Car Lease Payments As An Llc

Irs Letters Sample Letter From The And Tax Refund Example Complaint Resume Cover Tax Refund Donation Letter Lettering

Car Payment Schedule Template Beautiful Loan Table Car Payment Amortization Excel How Can An Auto Schedule Template Calendar Template Bill Calendar

What Is Considered A Second Home For Tax Purposes Pacaso

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

Tax Benefits And Implications Of Business Car Leasing Osv

Are Car Lease Payments Tax Deductible Moneyshake

Is It Better To Buy Or Lease A Car Taxact Blog

Tax Implications Of Business Car Leasing Company Car Lease Tax

Tax Implications Of Business Car Leasing Company Car Lease Tax

Car Payment Schedule Template Beautiful Loan Table Car Payment Amortization Excel How Can An Auto Schedule Template Calendar Template Bill Calendar

Should I Lease A Car Through My Limited Company Or Personally

Are Car Lease Payments Tax Deductible Lease Fetcher

Benefit In Kind Tax On Company Cars How Much Will You Pay Maxxia