are union dues tax deductible in canada

Le Conseil dEtat revient sur les conditions déligibilité au CIR de trois types de dépenses. Article continues below advertisement According to the Bureau of Labor Statistics about 11 percent of the US.

Are Union Dues Tax Deductible In Canada Ictsd Org

At 15 per cent of total earnings MoveUPs dues are lower than most Canadian unions.

. If you have any questions about the amount of union dues or any other amount reported on your T4 slip contact your employer. Child support deduction. Some want to know if union dues are tax deductible.

IRS guidelines advise that contributions to religious organizations which include churches synagogues temples mosques and so forth are tax deductible for charitable purposes. Just took a close look at mine it is on Box 44 of your T4. Labor force belongs to unions.

It goes on line 212 of your T1 Return. Union dues and professional association fees are tax deductible. If youre self-employed you can deduct union dues as a business expense.

For example if your annual income is 40000 and you paid 1000 as union dues your taxable income will be only 39000. There is still a way to reduce your tax liability through the deductibility of property management fees. At 15 per cent of total earnings MoveUPs dues are Union dues and professional association fees are tax deductible.

The amount taxpayers may deduct is shown on their T4-form Statement of Remuneration Paid. Through the Regional Pay System Public Works and Government Services Canada collects union dues directly from unionized employees pay. Union dues are set by the bargaining agents and calculated either by using a fixed rate or as a percentage of the employees salary.

All of your unreimbursed employee business expenses and other miscellaneous itemized deductions added together are more than 2 of your AGIOnly the amount over 2 AGI is deductible NOTE. At 15 per cent of total earnings MoveUPs dues are lower than most Canadian unions. At 15 per cent of total earnings MoveUPs dues are lower than most Canadian unions.

Are Union Dues 100 Tax Deductible In Canada. En labsence de tableau complet détaillant le contenu exact des missions réalisées justifiant de laffectation totale du personnel à des activités de RD. Incorporated clubs and trade unions are only eligible to deduct their membership dues as long as they do not charge entrance fees licensing or other fees.

But payroll should be deducting tax AFTER union dues are paid. Are union dues tax deductible in canada. Only union membership dues are deductible and union members may not deduct initiation fees licenses or other charges.

However the job-related expenses deduction is still available to people. Arrêt du Conseil dEtat du 19 Mai 2021 n432370 société Publicis Groupe. Union dues and professional association fees are tax deductible.

At 15 per cent of total earnings MoveUPs dues are lower than most Canadian unions. Between now and the end of February 2020 Canadians will receive a variety of receipts for expenditures made during the 2019 taxation year. You cannot claim charges for pension plans as membership dues even if your receipts show them as dues.

In some trades unions members may deduct subscription fees licenses and other charges only while members of unions may not do the same. It is deductible but it has already been accounted for in your biweekly tax withholding. Are union dues tax deductible in Canada.

When you file your tax returns the total amount of union dues you have paid during the year will appear on your T4 and your tax software will attribute the amount to line 212 but you wont be receiving extra refund because as said before its already accounted for. Union Dues or Professional Membership Dues You Cannot Claim. Are Synagogue Dues Tax Deductible 2019.

You cannot claim a tax deduction for initiation fees licences special assessments or charges not related to the operating cost of your company. Tax reform changed the rules of union due deductions. Are union fees pre or post tax.

For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. Taxation of Union Dues. If this happens you have to pay the dues yourself to your employer.

Union dues and professional association fees are tax deductible. Is Property Management Fee A Tax Write Off. Claiming a deduction for union or professional dues.

Workplace giving pre-tax Workplace giving post-tax Union or professional association fees. Furthermore you cannot claim a tax deduction for paying membership dues as a member of a pension plan. Union dues and professional association fees are tax deductible.

Whenever you contribute strictly for the benefit of the people these are the governments youd support. In addition to being considered income union dues as well as other contributions and assessments by a union are deductible miscellaneous expenses as well. The amount shown in box 44 of your T4 slips or on your receipts includes any GSTHST that you paid.

At 15 per cent of total earnings MoveUPs dues are lower than most Canadian unions. You can deduct any union dues paid by you from your taxable income. What does the employer do with the union dues that are deducted from an employees pay.

You Cannot Accruate Union Dues or Professional Membership Dues You cannot claim an employment tax deduction if you have to pay professional membership dues or as a condition of employment to your employer. Are Union Dues 100 Tax Deductible In Canada. Are Association Fees Tax Deductible In Canada.

If you are self-employed your union dues are deductible on your Schedule C as a business expense. From Canada Revenue Agency Website. Membership dues for trade unions or public servant associations may be deducted on income tax returns.

However most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act TCJA that Congress signed into law on December 22 2017. However if the taxpayer is self-employed and pays union dues those dues are deductible as a business expense. These figures can be adjusted based.

Professionals who are required by law to pay dues for professional boards or parity or advisory committees may also deduct those fees. You itemize your deductions Schedule A. Theyre tax deductible.

Pin On Start Your Own Business Small Business Tax Small Business Bookkeeping Business Tax Deductions

Where Do I Enter My Union And Professional Dues H R Block Canada

Can You Claim Union Dues On Taxes In Canada Ictsd Org

What Percentage Of Union Dues Are Tax Deductible In Canada Ictsd Org

How Much Are Canada Post Union Dues Cubetoronto Com

Do I Have To Pay Union Dues In Canada Cubetoronto Com

Are Union Dues Deducted Before Taxes In Canada Ictsd Org

Tax Checklist For Canadians Tax Checklist Tax Prep Checklist Canadian Money

Taxationassignmenthelp Now Available At Best Price From Bookmyessay Writers Tax Checklist Business Tax Financial Checklist

Canadian Tax Return Check List Via H R Block Ca Http Www Hrblock Ca Documents Tax Return Do Small Business Tax Deductions Business Tax Tax Prep Checklist

Can I Claim Union Dues On My Taxes Canada Ictsd Org

Are Union Fees Tax Deductible Canada Ictsd Org

Hr Resume Writing Guide And Tips Hr Resume Professional Resume Examples Job Resume

Different Types Of Payroll Deductions Gusto

Business Expense Spreadsheet For Taxes Spreadsheet Business Business Worksheet Business Tax Deductions

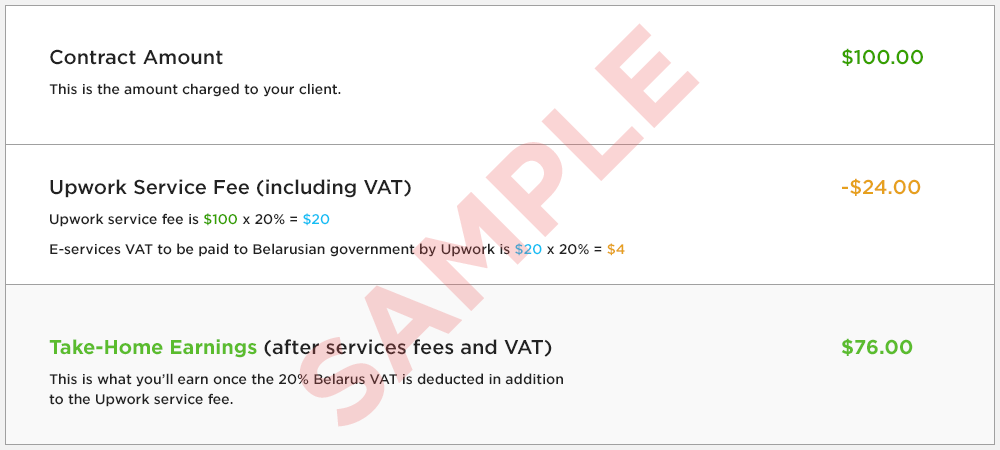

Value Added Tax Vat On Freelancer Fees Upwork Customer Service Support Upwork Help

What Are Payroll Deductions Article

Pin On Start Your Own Business Small Business Tax Small Business Bookkeeping Business Tax Deductions