nj electric car tax credit 2021

The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. Federal income tax credit of up to 7500 for eligible all-electric and plug-in hybrid cars purchased new in or after 2010.

Jeep 4xe Hybrid Tax Credits Incentives By State

By increasing sales of electric vehicles the Departments proposed rulemaking will.

. Colorados electric vehicle tax credits have been extended with a phaseout in place for purchases of electric vehicles in the following years. Yes the state of New Jersey has a tax credit for electric car drivers. The credit may also be.

Nj Electric Car Tax Credit 2021 New Jersey Approves 5 000 Ev Rebate Charging Infrastructure Electric Transit. Combined with the federal tax credit of up to 7500 EV drivers in the Garden State were getting as much as 12500 off the sticker price of their cars depending on the make and. How Much is the Electric Vehicle Tax Credit for a 2021 Tesla.

Charge Up NJ EV Rebate NJ State Sales Tax 6625 Cost After Incentives. ET on Wednesday September 15 2021. Beginning Today Customers Can Receive up to 5000 Incentive at the Point of Purchase.

Zero Emissions Vehicle ZEV drivers are exempt from the NJ sales tax. The credit begins to phase out for a manufacturer when that manufacturer sells. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

Answered on Jul 19 2022. The State of New Jersey will work to increase the number of EVs and related infrastructure to meet the following state goals. Ioniq Plug-In Hybrid Electric Vehicle.

Plug-in Electric Drive Vehicle Credit. 0 0 You Save 4366 58400 Audi 2021 e-tron sportback. The 2020 30C Federal Tax Credit has been extended.

Sales Tax Exemption - Zero Emission Vehicle ZEV NJSA. The coalition Tesla Inc. Plug-in Hybrid Electric Vehicles BEV.

The chart to the left shows how the number of electric vehicles registered in New Jersey has. Audi 2021 e-tron 222. The credit amount will vary based on the capacity of the.

Ioniq Plug-In Hybrid Electric Vehicle. And others have claimed the 35 million in funding is inadequate given New Jerseys EV goals - even though the states EV consumers pay no sales. TRENTON - The New Jersey Board of Public Utilities NJBPU opened Year 2 of its.

10 of new buses purchased by the New Jersey Transit. 5432B-855 The New Jersey Sales and Use Tax Act provides a sales and use tax exemption for zero emission. Sales and Use Tax Exemption.

0762021 Beginning Today Customers Can Receive up to 5000 Incentive at the. The credit ranges between 2500 and 7500 depending on the capacity of the battery. On January 17 2020 Governor Murphy.

Frequently Asked Questions About Buying An Electric Car Environment Texas

Eligible Vehicles Charge Up New Jersey

Bought Leased A New Ev In New Jersey In 2020 Big Check Might Come Your Way

New Jersey Offering 5 000 Off Evs Getjerry Com

Overnight Test Drives With The 2021 Ford Mustang Mach E Old Bridge Nj

Can You Really Shave 25 000 Off The Price Of An Electric Car

How To Get Money For Evs And Charging Chargepoint

Electric Vehicles Vs Gas Cars Total Cost Of Car Ownership Money

New Jersey Passes Landmark Ev Legislation Including 5 000 Rebate

Nj Amends 35m Ev Incentive Program To Spread Cash Among More Cars

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Electric Vehicle Planning For Businesses Hotels Apartments And More Greater Mercer Tma

The New Ev Tax Credit In 2022 Everything You Need To Know Updated Yaa

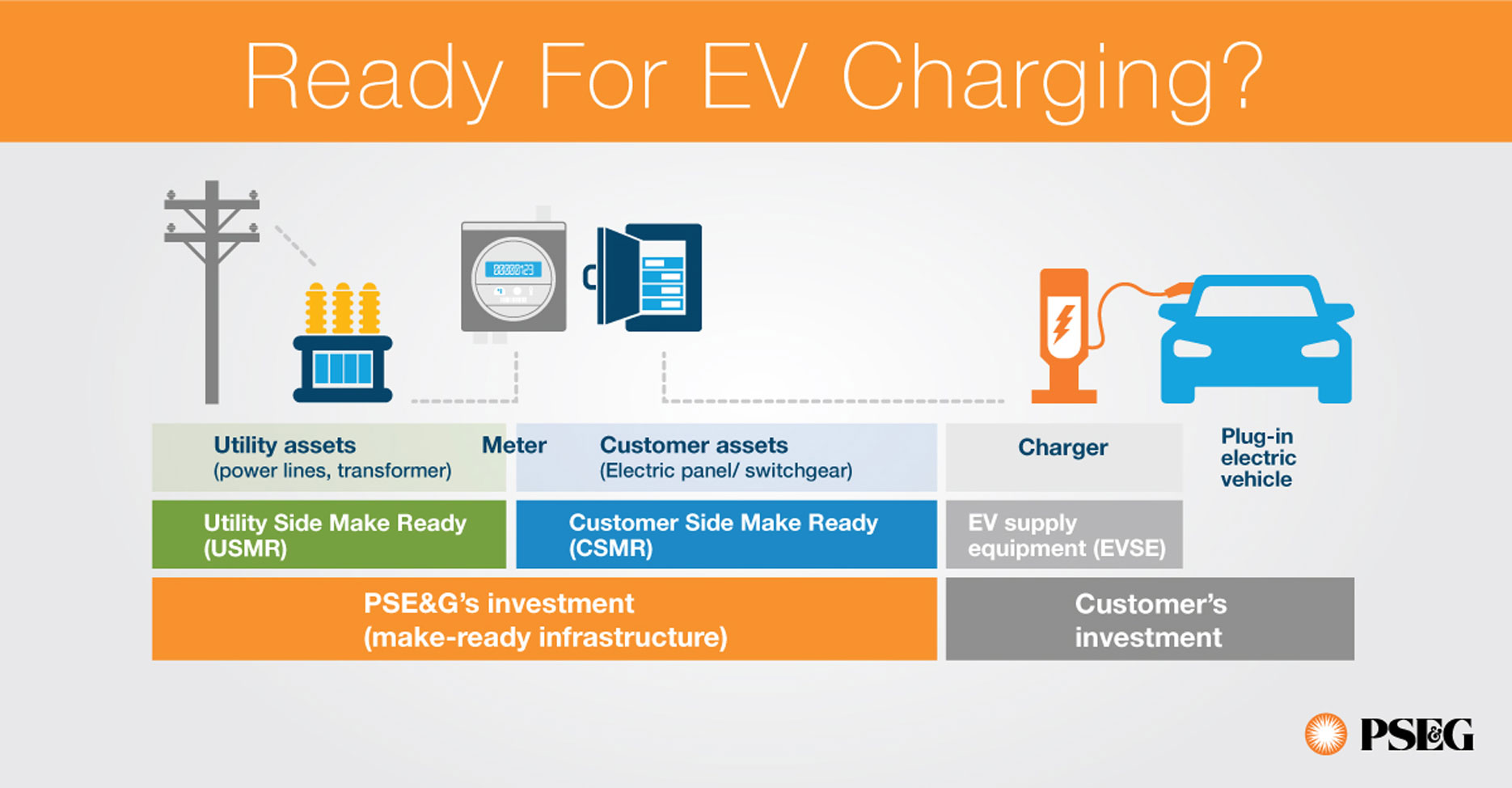

Electric Vehicle Program Pse G

Ev Tax Credit Calculator Forbes Wheels

State Electric Vehicle Tax Credits Electric Hybrid Alternative For 2022

Electric Vehicle Program Pse G

N J Is Offering Up To 4k To Help You Buy An Electric Car Here S What You Need To Know Nj Com